Not everyone needs life insurance. People who’ve accumulated enough wealth to cover their final expenses and who don't have dependents can usually forgo paying for life insurance. On the other hand, there are several groups that should strongly consider life insurance. Read on to discover some key points on who needs life insurance.

KEY TAKEAWAYS

These are few indicators.

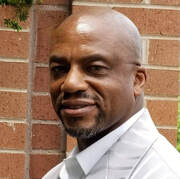

Dan Williams is an Insurance Consultant who help individuals use life insurance to lower debt and build wealth. Dan is a top notch hands on professional in the Financial Services Industry who is committed to serving people with good character and excellence. He crossed over from the the Credit Repair industry to Life Insurance when his mother passed without any insurance to help put her to rest. Since that momenthe has made it it mission to educate as many people as he can about the importance of protecting yourself, building wealth and leaving a legacy. Dan believes that everyone deserves first class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty while over 100,000 individuals with a plan of action and peace of mind for the future. Dan’s clients’ include everday people in additionto major financial banking institutions, real estate brokerages, mortgage lenders that are located all over the United States.

Contact Dan Williams for more information and to see others benefits that comes with life insurance.

(540) 628-5167

[email protected]

Note: This article is not an endorsement by Forest Of The Rain Productions

KEY TAKEAWAYS

- Couples should each have life insurance in case one passes away so the other can maintain the same quality of life.

- People with young children are strongly recommended to have life insurance to protect their families.

- Homeowners should take out life insurance so that the death benefit can pay off the mortgage.

- Business owners and those who want to pass down a financial legacy are also advised to purchase life insurance.

- If an individual has accumulated enough wealth to take care of their family upon their passing, then life insurance may not be needed.

These are few indicators.

Dan Williams is an Insurance Consultant who help individuals use life insurance to lower debt and build wealth. Dan is a top notch hands on professional in the Financial Services Industry who is committed to serving people with good character and excellence. He crossed over from the the Credit Repair industry to Life Insurance when his mother passed without any insurance to help put her to rest. Since that momenthe has made it it mission to educate as many people as he can about the importance of protecting yourself, building wealth and leaving a legacy. Dan believes that everyone deserves first class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty while over 100,000 individuals with a plan of action and peace of mind for the future. Dan’s clients’ include everday people in additionto major financial banking institutions, real estate brokerages, mortgage lenders that are located all over the United States.

Contact Dan Williams for more information and to see others benefits that comes with life insurance.

(540) 628-5167

[email protected]

Note: This article is not an endorsement by Forest Of The Rain Productions