Life insurance for homeowners is a way to help protect the financial investment you make when you purchase a home if something unforeseen happens to you. The amount you put into your home is substantial. Beyond the listed price are closing costs, inspections, and taxes. When your family relocates to your new home, movers must be hired, household items must be purchased, and utilities must be set up. Depending on your choice of residence, you may also need to pay for repairs or renovations before (or shortly after) you move in. It’s a lot to think about, so it’s not surprising that many people overlook the importance of life insurance and increasing their coverage when buying a home.

When you become a homeowner, purchasing life insurance is a way to protect your family and ensure that your loved ones can stay in the home if anything unexpected happens to you. If you already own life insurance, you’ll likely need to increase your coverage to sync it with the amount of your mortgage. Your life insurance policy’s benefit—the amount your beneficiary will receive—should be enough to pay off the mortgage. That way, you know your family will not lose their home.

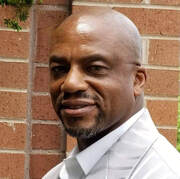

Dan Williams is an Insurance Consultant who help individuals use life insurance to lower debt and build wealth. Dan is a top notch hands on professional in the Financial Services Industry who is committed to serving people with good character and excellence. He crossed over from the the Credit Repair industry to Life Insurance when his mother passed without any insurance to help put her to rest. Since that momenthe has made it it mission to educate as many people as he can about the importance of protecting yourself, building wealth and leaving a legacy. Dan believes that everyone deserves first class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty while over 100,000 individuals with a plan of action and peace of mind for the future. Dan’s clients’ include everday people in additionto major financial banking institutions, real estate brokerages, mortgage lenders that are located all over the United States.

When you become a homeowner, purchasing life insurance is a way to protect your family and ensure that your loved ones can stay in the home if anything unexpected happens to you. If you already own life insurance, you’ll likely need to increase your coverage to sync it with the amount of your mortgage. Your life insurance policy’s benefit—the amount your beneficiary will receive—should be enough to pay off the mortgage. That way, you know your family will not lose their home.

Dan Williams is an Insurance Consultant who help individuals use life insurance to lower debt and build wealth. Dan is a top notch hands on professional in the Financial Services Industry who is committed to serving people with good character and excellence. He crossed over from the the Credit Repair industry to Life Insurance when his mother passed without any insurance to help put her to rest. Since that momenthe has made it it mission to educate as many people as he can about the importance of protecting yourself, building wealth and leaving a legacy. Dan believes that everyone deserves first class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty while over 100,000 individuals with a plan of action and peace of mind for the future. Dan’s clients’ include everday people in additionto major financial banking institutions, real estate brokerages, mortgage lenders that are located all over the United States.