Whole life is a form of permanent life insurance that differs from term insurance in two ways. Whole Life insurance never expires as long as you keep making premium payments. Additionally, Whole Life Insurance provides some cash value in addition to the death benefit, which can be a source of funds for future needs.

What are some benefits to Whole Life Insurance? Whole Life Insurance allows you to borrow against or withdraw from the policy for other financial needs. It is essential to know that loans and withdrawals are generally tax-free, and loans may have beneficial terms. You can lock in your premiums for life.

However, there are drawbacks to Whole Life Insurance. For example, the costs of Whole Life Insurance are more than comparable term policies. Also, if you let the policy lapse within the first few years, you could face surrender charges. Finally, any outstanding loans will reduce your death benefit.

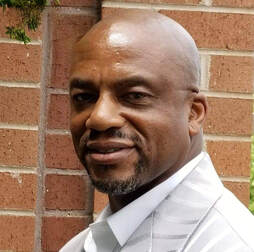

Dan Williams is an Insurance Consultant who helps individuals use life insurance to lower debt and build wealth. Dan is a top-notch, hands-on professional in the Financial Services Industry committed to serving people with good character and excellence. He crossed over from the Credit Repair industry to Life Insurance when his mother passed away without any insurance to help put her to rest. Since that moment, he has made it his mission to educate as many people as possible about the importance of protecting yourself, building wealth, and leaving a legacy. Dan believes that everyone deserves first-class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty. At the same time, over 100,000 individuals have aplan of action and peace of mind for the future. Dan’s clients include everyday people, major financial banking institutions, real estate brokerages, and mortgage lenders all over the United States.

What are some benefits to Whole Life Insurance? Whole Life Insurance allows you to borrow against or withdraw from the policy for other financial needs. It is essential to know that loans and withdrawals are generally tax-free, and loans may have beneficial terms. You can lock in your premiums for life.

However, there are drawbacks to Whole Life Insurance. For example, the costs of Whole Life Insurance are more than comparable term policies. Also, if you let the policy lapse within the first few years, you could face surrender charges. Finally, any outstanding loans will reduce your death benefit.

Dan Williams is an Insurance Consultant who helps individuals use life insurance to lower debt and build wealth. Dan is a top-notch, hands-on professional in the Financial Services Industry committed to serving people with good character and excellence. He crossed over from the Credit Repair industry to Life Insurance when his mother passed away without any insurance to help put her to rest. Since that moment, he has made it his mission to educate as many people as possible about the importance of protecting yourself, building wealth, and leaving a legacy. Dan believes that everyone deserves first-class service and a second chance. With a focus on consumer education and providing a unique and personalized experience, he is committed to working to eliminate the burden of financial uncertainty. At the same time, over 100,000 individuals have aplan of action and peace of mind for the future. Dan’s clients include everyday people, major financial banking institutions, real estate brokerages, and mortgage lenders all over the United States.